By Stan Beecham

Most elite athletes – from golfers to gymnasts, placekickers, and baseball pitchers – tend to be very focused, disciplined, and perfectionistic. Their belief is that the desire to be “perfect” will end up making them better.

Unfortunately, this is not always true. More often than not, the desire to be perfect actually hinders performance. When we try to be perfect, we assume success equals not making any mistakes, when, in fact, success is your response to the mistake.

Why Adversity Is a Good Thing

People who tend to be perfectionists do not respond well to adversity or defeat. Their belief is: “If I’m doing it correctly, there will be no struggle or failure.” However, loss, pain, defeat, struggle, and embarrassment are the great motivators to change – and change always leads to improvement.

Not understanding that failure is part of the journey of success will lead to more failure – not perfection. Perhaps the best and easiest way to define success is this: Fall down 100 times; get up 101.

We must accept that, every now and then, we will have a bad day. When I talk with elite athletes, I ask them the following question: “If you were the best athlete in the world in your event, how frequently would you have a bad day?” Surprisingly, many great athletes believe they should get to a point where they no longer have any bad days (or failures). But, in reality, the best and most self-aware of those athletes report that, during the course of a 30-day month, they have somewhere between three and six bad days. They understand that having a bad day is simply part of the process. The ability to accept these fluctuations in performance allows athletes to remain fully engaged in their training and keep their goals high.

Likewise, the inability to make sense of your failures will ultimately cause you to become discouraged and less motivated, and your performance will decline as a result. How you function during a good day does not define your character. It’s how you function during a bad day that is the true test.

How Do You Respond to Failure?

It is always beneficial for me to see an athlete I am working with have a bad day because it is the truest measure of that person’s competitive ability. Do they exacerbate the bad day by becoming even more critical of themselves or someone else? Do they feel sorry for themselves and pout? Do they make excuses and quit? For you to reach your potential, you must know how you respond to poor performance. This is critical information without which you simply cannot move forward.

If perfect is not the goal, what is? It’s simple: Do your best. That’s it. Each day, make it your intention to do the very best you can with what you have that day. Keep a daily journal and give yourself a W or an L for each day. If you did the best you could that day, you get a W. If you did not do your best, you get an L. The goal is to have six or fewer L’s in a month. And you never want to have two consecutive L’s. It’s okay to have a bad day, but you must make yourself recover quickly and get back on track.

Remember: The goal is not to be perfect. It’s to do your best and recover quickly from failure.

Dr. Stan Beecham is a sport psychologist, director, and founding member of the Leadership Resource Center in Atlanta, Georgia, and author of Elite Minds: How Winners Think Differently to Create a Competitive Edge and Maximize Success. Since 1998, Beecham has been helping organizations maximize performance and realize the full potential of their human resources. Senior executives utilize Dr. Beecham’s expertise to guide them through the process of selecting and developing high-performance teams. In addition to his coaching and consulting engagements at the Leadership Resource Center, he is a professional speaker and writer committed to advancing the science of leadership development. Visit his Website at http://www.drstanbeecham.com.

Dr. Stan Beecham is a sport psychologist, director, and founding member of the Leadership Resource Center in Atlanta, Georgia, and author of Elite Minds: How Winners Think Differently to Create a Competitive Edge and Maximize Success. Since 1998, Beecham has been helping organizations maximize performance and realize the full potential of their human resources. Senior executives utilize Dr. Beecham’s expertise to guide them through the process of selecting and developing high-performance teams. In addition to his coaching and consulting engagements at the Leadership Resource Center, he is a professional speaker and writer committed to advancing the science of leadership development. Visit his Website at http://www.drstanbeecham.com.

Muriel Siebert established her legacy as a trailblazer when she became the first woman to own a seat on the New York Stock Exchange on December 28, 1967. At the time, her historic application caused an uproar. No woman had ever had a seat on the Exchange before. Facing ridicule and steep opposition, Siebert got rejections from nine men before she finally found someone to sponsor her.

Muriel Siebert established her legacy as a trailblazer when she became the first woman to own a seat on the New York Stock Exchange on December 28, 1967. At the time, her historic application caused an uproar. No woman had ever had a seat on the Exchange before. Facing ridicule and steep opposition, Siebert got rejections from nine men before she finally found someone to sponsor her.

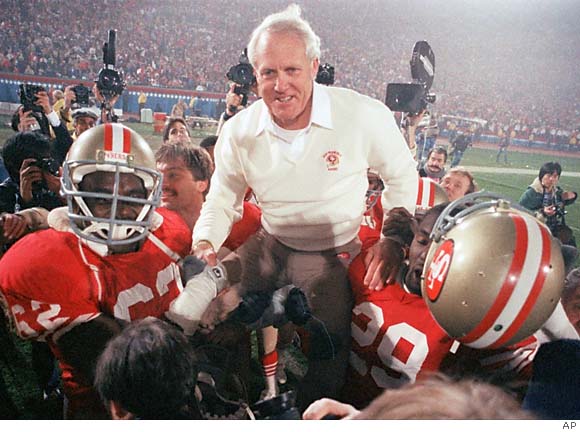

Find effective strategies. Vision is great, but if you cannot find a way to connect to it from the current reality, it’s useless. One leader who has been able to bring the imaginary to the realm of reality is football legend Bill Walsh. The legendary coach led his teams to amazing NFC division championships and NFC titles and earned a spot in the NFL Football Hall of Fame. One of his many strengths was as an offensive coach, constantly reading the field and creating strategies that would maximize his players’ skills and exploit the weaknesses of their opponents.

Find effective strategies. Vision is great, but if you cannot find a way to connect to it from the current reality, it’s useless. One leader who has been able to bring the imaginary to the realm of reality is football legend Bill Walsh. The legendary coach led his teams to amazing NFC division championships and NFC titles and earned a spot in the NFL Football Hall of Fame. One of his many strengths was as an offensive coach, constantly reading the field and creating strategies that would maximize his players’ skills and exploit the weaknesses of their opponents. Be a great communicator. The key to communicating is connecting with the audience. Former President Ronald Reagan was so well known for his ability to reach the American people that he earned the nickname, “The Great Communicator.” He didn’t use fancy language or rhetoric to win people over; in fact, it was the very simplicity of his style, coupled with his humor, which made him so popular. A senior leader’s job is to communicate corporate goals to employees and motivate them to achieve those goals.

Be a great communicator. The key to communicating is connecting with the audience. Former President Ronald Reagan was so well known for his ability to reach the American people that he earned the nickname, “The Great Communicator.” He didn’t use fancy language or rhetoric to win people over; in fact, it was the very simplicity of his style, coupled with his humor, which made him so popular. A senior leader’s job is to communicate corporate goals to employees and motivate them to achieve those goals. Listen. Sharing information is one skill; collecting information is another, equally valuable skill. And the queen of listening very well may be Meg Whitman, who is known for her humility and passion for listening to both her customers and employees.

Listen. Sharing information is one skill; collecting information is another, equally valuable skill. And the queen of listening very well may be Meg Whitman, who is known for her humility and passion for listening to both her customers and employees. Be inspirational. If there is one skill that can make up for a multitude of sins in other areas, it just might be the ability to inspire. People want to be a part of something great, something larger than themselves. Just ask business legend, former General Electric CEO Jack Welch. Known for his passion, commitment, and sense of fun, Welch led by example and took pride in his ability to develop his people. He regularly rewarded the highest performers (and cut the bottom feeders), thereby encouraging workers to make it to the top. “Giving people self-confidence is by far the most important thing that I can do. Because then they will act,” Welch has said.

Be inspirational. If there is one skill that can make up for a multitude of sins in other areas, it just might be the ability to inspire. People want to be a part of something great, something larger than themselves. Just ask business legend, former General Electric CEO Jack Welch. Known for his passion, commitment, and sense of fun, Welch led by example and took pride in his ability to develop his people. He regularly rewarded the highest performers (and cut the bottom feeders), thereby encouraging workers to make it to the top. “Giving people self-confidence is by far the most important thing that I can do. Because then they will act,” Welch has said.

L.L. Bean was born in 1912, when Leon L. Bean (who was orphaned at age 12 and left school after completing the eighth grade) designed his own boot with a leather upper and rubber bottom. According to company legend, the first 90 shipments came back defective. Bean dispensed full refunds, borrowed $400, and launched a redesigned boot that became highly popular.

L.L. Bean was born in 1912, when Leon L. Bean (who was orphaned at age 12 and left school after completing the eighth grade) designed his own boot with a leather upper and rubber bottom. According to company legend, the first 90 shipments came back defective. Bean dispensed full refunds, borrowed $400, and launched a redesigned boot that became highly popular.